I was not aware that launching of a banking product will have so much fun. I am talking about my experience at the Kotak Exclusive Launch party organized by IndiBlogger, which were my second IndiBlogger meet in a span of 3 days and my fourth IB meet in this year.

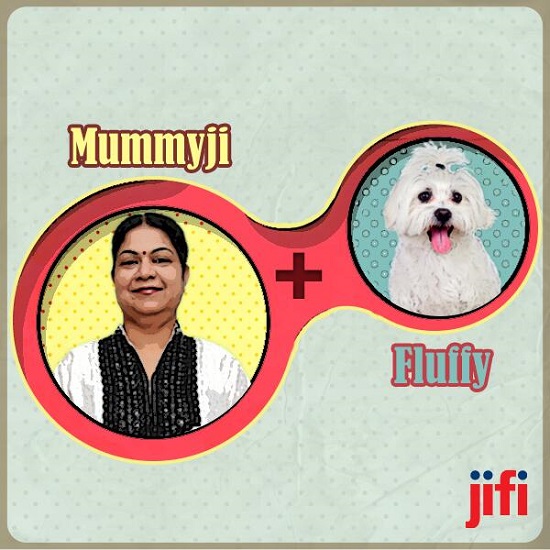

jiFi – sounds a bit different, is not it. But you might ask me how can I pronounce it?

Well the answer is explained over here:

It means you can pronounce JiFi in the way as you pronounce Ji in Mummy Ji and Fi in Fluffy. Clear?

I always wanted to learn how to open a business checking account online. So, this JiFi account was a new social banking account brought by Kotak Banks. Although I don’t had account in Kotak, thought to open so many times, but then never thought to increase one more bank account in my name. The reasons why, it is really difficult to manage minimum balance in one or two bank accounts which I have already, then how can I manage one more bank accounts?

The moment we joined the launch event, the very first thing which attracted me from this new banking account is that it is a zero balance account. In fact, it is nothing new then a bank account, only thing which separates it from other bank accounts by Kotak Bank only is that it is a zero balance account. Remaining all the account opening stuffs like providing documents, providing 5000 Rs. Cheque at the time of opening the account, and all other things remain same which you can expect while opening a bank account.

So what is different?

There are some things which makes a Kotak JiFi account different than any other bank accounts, here are a few of them:

Zero Balance Account

As per Kotak bank it is a completely zero balance account. They are not going to charge you anything for having a zero balance in your account. Good thing, especially for guys like us, whose balance never touches the four figure marks in a month 🙁

Interest Rate

Normally Kotak bank provides 6% of interest rates, but here comes the special trick of them to announce this JiFi accounts as a zero balance account, as they says that unless you have at least 25000 Rs. in your account, they won’t give you any interest rates. So you can enjoy the banking privileges without getting any interest for any amount less than 25000 Rs.

Yes they are a non-interest banking account, but once you reach to the minimum threshold of INR 25000 Kotak will pay you high interest by automatically creating term deposit for your cash. Is nto it sounds good?

Platinum Debit Card

The best thing along with a JiFi account is that they come with a platinum debit card. Although I have not yet received it, but might be it will reach to my home today only.

Social Banking

The best feature associated with JiFi account is the social banking feature. You can easily bank with Twitter. You can get your account balance, transaction history, and many other features with the help of a tweet from your twitter handle only.

Is not it sounds great for youngsters?

Yes mind the word that this banking account is meant for youngsters only. I cannot help you if you consider yourself as a young, but you don’t know how to manage a twitter handle or a Facebook account.

Worried after hearing this?

I suppose yes, as everyone will worry about the security features after hearing the fact that you can access your bank account through twitter.

We all who attended this IndiBlogger meet were having concerns about it, and Kotak bank assured us that no one will be able to access your account details, as it will be stored on a highly secured virtual location, and not even the Kotak bank employees too have the access to this twitter handle through which we will get our messages about account details.

Awesome one, especially it made us proud that we are using twitter and we can safely use this banking accounts 🙂

Collect Points

As with any social interactive program, here also you can refer your friends and collect points through it, which you can utilize later on. With some activities of sites like FB and Twitter you can be able to collect many points. One of our fellow bloggers get around (near about) 20,000 points in between the event only, and we were shocked to see him, as with my poor net connection over there I scored only 100 points 🙁

Remember that one point is equivalent to one Rupee. Is not it great?

So those were some of the highlights of opening a new JiFi bank account with Kotak Mahindra Bank, along with some other benefits like mobile apps, moneywatch, loyalty clubs, ect. which you can utilize after opening the account over there. If you like to have a JiFi account you can even ask me for an invitation so that I too can get a referral bonus 😉

This IndiBlogger meet was really an awesome event and we enjoyed it to the fullest. Hope to attend some more such events in coming days.

Leave a Reply